Are you a business owner seeking peace of mind in the face of potential mishaps? Business insurance is there to safeguard you from unforeseen circumstances that could disrupt your operations. This article is going to explore the benefits of taking out an insurance policy for your business. Let’s delve into why your enterprise needs that extra layer of protection.

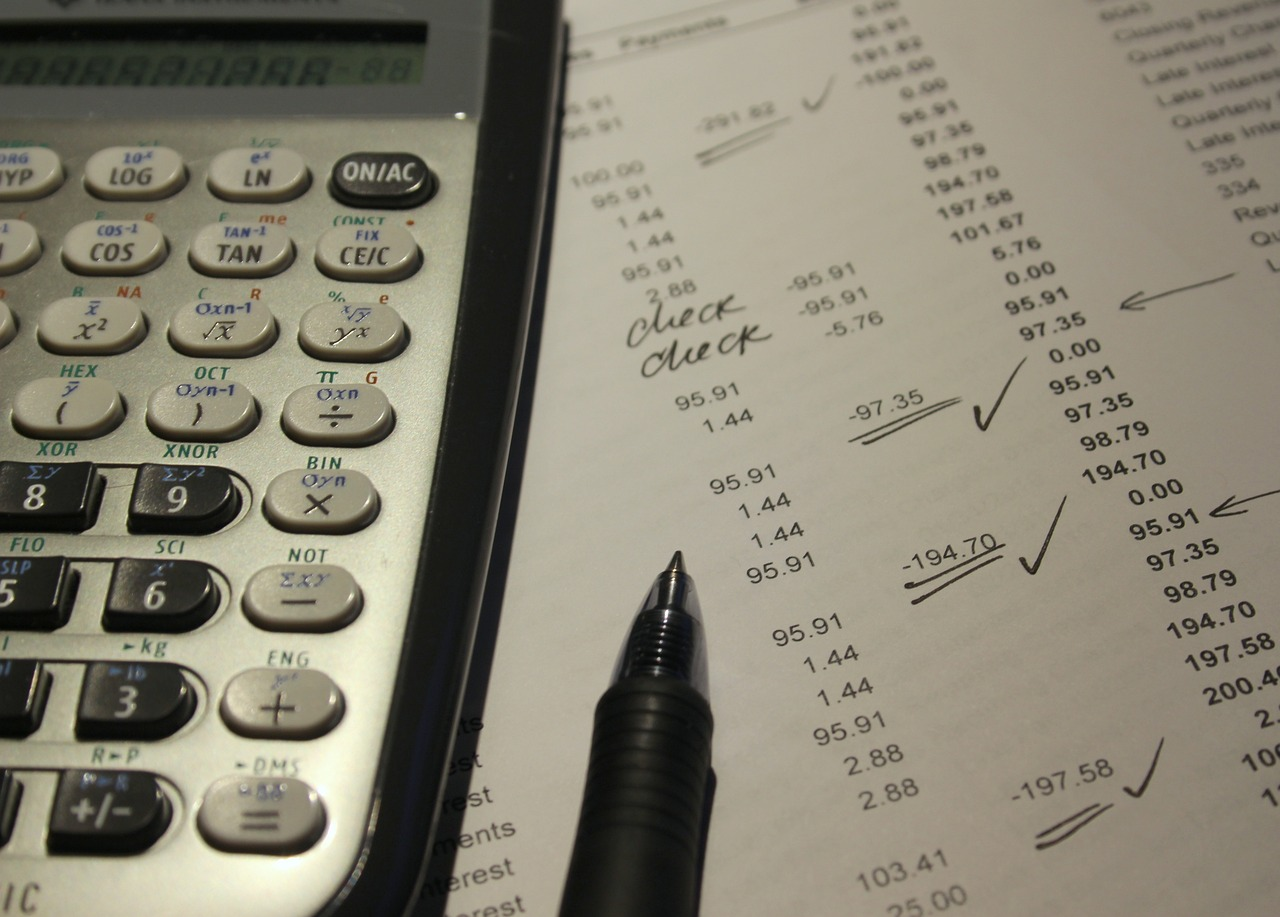

Financial Protection

Business insurance is a crucial financial safety net that aids in the sustainability of a company. It’s not just about mitigating losses from unfortunate incidents. Company owners know that commercial insurance coverage is about providing the financial support necessary to rebuild and bounce back. When unforeseen events such as theft, natural disasters, or lawsuits occur, the financial implications could be detrimental to a company.

This is where business insurance steps in. It covers these unexpected costs, preventing you from tapping into your business funds or personal savings. Whether it’s property damage requiring costly repairs, legal claims leading to hefty attorney fees, or business interruptions that result in loss of income, insurance has you covered. Thus, business insurance isn’t just an added expense — it’s an investment in the robustness and longevity of your business.

Liability Coverage

In the litigious society we live in, even the smallest missteps can lead to significant legal claims. Whether it’s a customer tripping over a loose carpet in your store or a product malfunction causing harm, businesses are continually exposed to liability risks. This insurance policy covers legal costs and payouts for which the insured party would be found liable, up to the policy limits. For businesses, this could mean protection against claims for personal injury, property damage, and even advertising errors.

Furthermore, professional liability insurance can cover negligence claims that result from mistakes or failure to perform. Essentially, this type of coverage offers peace of mind, knowing that your business assets are protected against unforeseen claims. In essence, it’s a safety net that ensures the smooth operation of your business in the face of potential lawsuits.

Risk Management

Every business is facing potential risks that can have dire consequences. Here are some insurance can help with:

- Property damage

- Liability claims

- Professional liability

- Worker’s compensation

- Business interruption

- Cybersecurity and data breach

- Product liability

- Commercial auto insurance

- Key person insurance

- Fidelity bonds

- Environmental liability

- Supply chain interruptions

Insurance allows businesses to transfer the cost of potential loss to an insurance company by paying a relatively small premium. This facilitates the management of unpredictable risks such as property damage, lawsuits, or business disruptions.

Additionally, insurance can provide coverage for specific industry-related risks, ranging from cybersecurity breaches to supply chain interruptions. Essentially, business insurance acts as a bulwark, enabling businesses to operate confidently amidst inherent uncertainties.

Business Continuity

A good policy also provides a safety net for businesses, helping them weather financial storms that could otherwise force them to cease operations. In the event of a significant disruption, like a natural disaster, theft, or major lawsuit, business interruption insurance can cover lost income until normal operations can resume. This allows businesses to pay ongoing expenses, such as salaries and rent, during the interruption period.

Similarly, in the case of key person insurance, a business can maintain operations even after the sudden loss of a crucial person within the organization. In essence, having the right insurance coverage ensures that businesses can navigate through uncertainties and disruptions, ultimately contributing to their longevity and sustainability.

Employee Protection

Workers’ compensation, a fundamental component of business insurance, covers medical expenses, disability, and lost wages if an employee is injured or falls ill due to work-related circumstances. This ensures that employees are not financially burdened during their recovery period.

Moreover, in the unfortunate event of an employee’s death due to a workplace accident, this insurance provides a death benefit to the employee’s family. In essence, business insurance not only safeguards the business and its assets but also provides a vital safety net for the workforce, contributing to employee retention and morale.

Credibility and Client Assurance

When you’re insured, it shows that you take risk management seriously and are prepared to compensate for any potential damages or losses. This assurance gives them confidence in doing business with you. Moreover, certain contracts may require you to have specific types of insurance, so being insured opens up more opportunities.

In essence, having business insurance signals trustworthiness and professionalism, setting you apart in a competitive market. It tells your clients that if something goes wrong, there’s a safety net in place, providing them with peace of mind and reinforcing the reliability of your business.

In conclusion, regardless of how meticulous you are in managing your business, unforeseen circumstances can still occur. Having a comprehensive business insurance policy in place provides a safety net that allows you to steer your business confidently through uncertainties. Keep your business, employees, and reputation safeguarded — because your enterprise isn’t just a business; it’s your livelihood.